Brexit will affect the e-commerce market in Europe. A strong Brexit strategy for your e-commerce business requires knowing the potential impacts and how to prepare your business, particularly for shipping after Brexit. In this article, we take a look at how Brexit could affect day-to-day operations and provide a step-by-step guide on how to ship post Brexit. Do you sell into the UK? Don’t let Brexit stop your products reaching your customers! This guide will help you with practical tips

We will take a look at the following questions.

- What is Brexit and who will it affect?

- How will Brexit affect e-commerce in Europe?

- Who will Brexit affect?

- Shipping after Brexit: How to send packages post-Brexit?

- Bonus: 3 steps to prepare your e-commerce store for Brexit

What is Brexit?

On the 31st of January 2020, The UK (England, Scotland, Wales, and N. Ireland) departed from the European Union. The UK left with a pre-negotiated Withdrawal deal negotiated by the current Prime Minister, Boris Johnson.

Although the UK has formally left the EU, there is a transition period set to last until December 2020. During this transition period, essentially everything will remain the same. The UK will still be a part of the EU’s Customs Union and Single Market, but it will have no place in the political institutions and so have no members of the European Parliament.

All EU rules and law still apply to the UK in this transition period. So nothing changes for businesses or the public. This gives everyone more time to prepare for all the new agreements that will be made and will apply after the 31st of December. The agreements take into account how the EU will be able to do business in and with the UK after the transition period.

If both countries agree on the agreements, there will be a deal.

What happens when there’s no EU trade deal after the transition period?

This would leave the UK trading on the World Trade Organization terms with the EU. This means that most UK goods would be subject to tariffs until a free trade deal would be arranged.

No matter what happens the relationship between the UK and the EU will change. There will be checks at the border and e-commerce businesses that ship to the UK will have to deal with declaring goods you export or import.

Brexit Impact on E-commerce?

The UK is Europe’s current leader and biggest market for e-commerce. 93% of Brits shop online and spend on average +900 euros per person, per year.

UK shoppers aren’t afraid of purchasing overseas either. 52% of overseas e-commerce orders are from the US and China. And Europe isn’t far behind, with 9% of European purchases coming from Germany.

With the UK’s e-commerce market being so developed, residents from the European Union also like to shop at British webshops. Britain is the second most popular e-commerce destination for Europe (after China). After Brexit, 70% of European e-shoppers may stop buying from UK websites. And 69% of UK shoppers could stop buying cross-border altogether.

Brexit could affect e-commerce in Europe in the following ways:

Brexit Affecting Customs and Longer Shipping Times

It is likely that Britain will no longer benefit from the open borders that enable the freedom of movement of goods and people. This means stricter customs regulations for packages entering and leaving the UK and EU. It’s even possible that some British products could even be restricted or prohibited.

Longer shipping times are a likely outcome for packages crossing from either side. Especially during the first months of 2021 parcels have a higher chance to be delayed.

Brexit Affecting Tariffs and VAT

This depends on the future trade deals and relationships determined in the coming year. However, it could transpire that both the UK and the EU will impose tariffs on each other’s imports. This could result in prices rising and risks sparking a trade war between the two entities.

VAT laws are a major point of contention for the Brexit negotiations already. If the UK cuts ties with the EU completely after the transition period, UK businesses will no longer have to collect any VAT on products sold to EU customers. This is a plus for lowering prices, but Britain will also no longer be able to use the EU VAT refund system.

Who will Brexit affect?

Brexit could affect you if you fall into the following categories:

- Online stores within the EU that are selling to consumers within the UK

- Global companies that sell into both the UK and the EU

- British online stores selling anywhere (whether domestically, globally or into the EU)

- UK businesses shipping domestically or internationally

- Businesses that import goods from the UK

Brexit affecting online stores selling their products in the UK

Online stores that are located in a country within the EU will face changes. This all depends on the deal that will or won’t be made. But one thing is for sure these businesses have to file a tax return in the United Kingdom and you need an EORI number to ship your products to the UK.

In case there is no formal agreement by the end of this year, the UK will immediately leave the customs union and the internal market. In that case, there will be no trade agreement and the World Trade Organisation rules will automatically apply. This contains agreements on import tariffs, taxes and customs procedures.

The disappearance of the freedom of movement of goods and people could mean big changes to operations.

Brexit affecting global companies that sell into both the UK and the EU

Global companies that sell into both the UK and the EU will need to adjust their shipping and selling policies. It’s most likely the UK will have separate shipping and selling rules from the rest of the EU. That means the two will need to be dealt with separately.

Brexit affecting British businesses selling anywhere

British businesses selling into the EU could also face a lot of changes. If future relations with the EU do not include the freedom of movement of goods, then shipping to the EU could become the same as shipping internationally across the globe. This includes customs forms, import and export duties, and stricter regulations. It will become a more complex process than the current situation. Therefore, it’s important to have a strong international shipping strategy.

Even British companies that sell globally could face new regulations with shipping and trade. At the moment Britain trades with the rest of the world as an EU member. If the UK reverts to WTO terms, some 40 existing trade agreements between the EU and dozens of countries would no longer apply to the UK. We therefore don’t know what the new trade deals will be and how the UK will handle trade with countries across the globe. This could mean restrictions or prohibitions with new trade barriers like tariffs and import duties could arise.

Brexit affecting business that import goods from the UK

If you import any of your supply chain or products from outside of the UK, your process may be affected, including an increase in time and costs.

Another issue could be sourcing enough workforce for your order fulfilment. The current free movement of EU nationals into the UK is something that could change. According to the BBC, 19% of EU migrants work in warehousing, meaning it could become more difficult in the future to source employees.

Shipping after Brexit: How to send a package post-Brexit?

No matter what the future will look like, it’s important to prepare a strong international shipping strategy. This will help you be ready for any Brexit scenario. And an added bonus – it can help you ship to anywhere else across the world!

EORI-number for shipping to the UK

Although much is still uncertain, at least it is clear that from the first of January in 2021 you will need an EORI number to move products between the UK and the EU. An EORI number is an identification number you need to do business across borders. Customs use this number to exchange information quickly.

You can easily apply for an EORI number from the authorities. It is important that you need a number starting with GB in order to send to the UK from 1 January. For shipments to Northern Ireland you will need a separate number.

Customs and longer transit times

It is very likely that Britain will no longer benefit from the open borders that allow the free movement of goods and people. This means stricter customs rules for packages entering and leaving the UK and the EU.

Some British products may even be restricted or banned. In addition, the Brexit may lead to longer transit times. As long as there is no trade agreement, the rules of the WTO apply and import duties must be taken into account.

The right custom declaration forms to ship post-Brexit

When the UK formally leaves the EU and the transition period is over, it’s good to know what customs forms you will need to ship to countries within the EU. If the UK is considered a non-EU country, there will be no free movement of goods between the two entities, and if you don’t complete customs forms correctly, your package could be delayed or blocked.

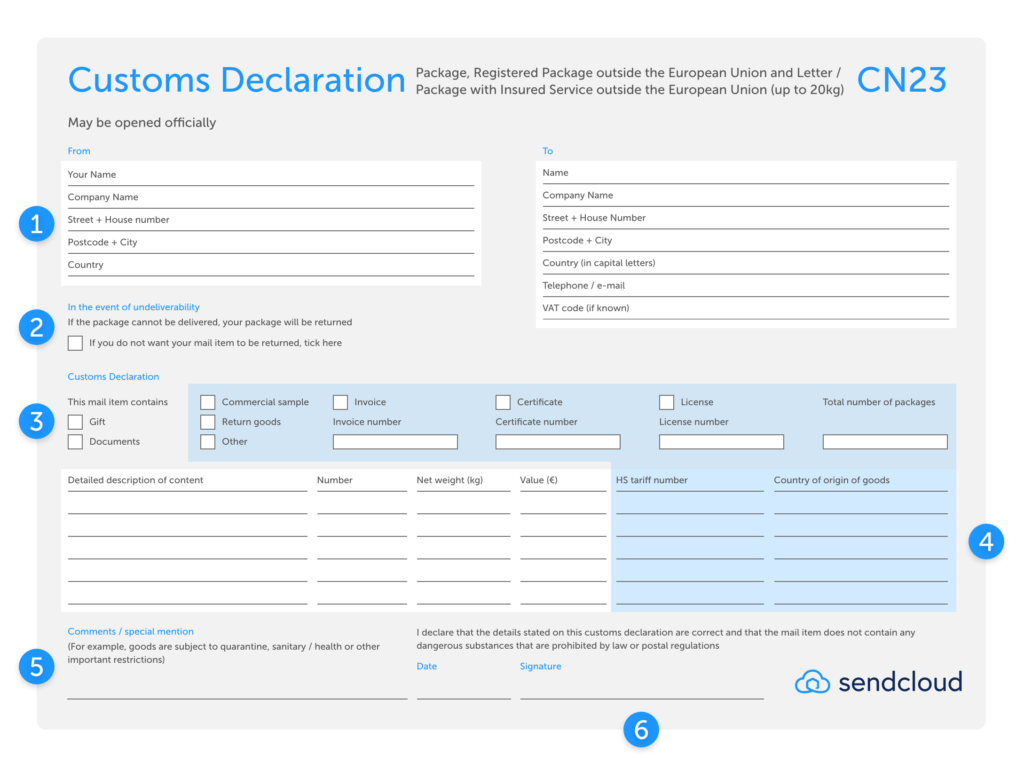

It could be possible that a Commercial Invoice, a CN22 or CN23, and a Certificate of Origin are required.

If you’re not familiar with these forms, then check out the following:

- Customs declaration CN22: A CN22 is needed when sending goods weighing up to 2 kg and up to 425 euros in value and shipping with a postal carrier like Correos, PostNL, bpost or Poste Italiane. It should be the CN22 customs declaration to the outside of the package.

- Customs declaration CN23: A CN23 is needed when sending goods weighing over 2 kg and/or more than 425 euros in value and and shipping with a postal carrier like Correos, PostNL, bpost or Poste Italiane. The CN23 declaration is larger than the CN22 declaration and must be attached to the outside of the package in a clear envelope. You will need to include a second copy inside the package as well.

- Despatch Note CP71: This is a mandatory document that accompanies the CN23 declaration.

- Commercial Invoice: A Commercial Invoice needs to be attached to any commercial shipment going abroad. The commercial invoice is a mandatory customs document which includes information about the contents of the package and any agreed terms, such as who pays the customs charges (the Incoterms). Normally you need to attach three copies of the Commercial Invoice; one for the country you are exporting from, one for the country you are sending to, and one for the recipient. Attach two copies to the outside of the package in a “packing list envelope”. Then we advise putting one Commercial Invoice inside the package for your customer.

- Certificate of Origin: The Certificate of Origin shows the origin of the product and therefore certifies in which country a product was made. This is required when importing goods from a number of countries outside the EU. A CO can be requested from the Chamber of Commerce website, and you can check whether a CO is required for your shipment using this link.

Free Tool: Create your own customs declaration form

We love to make things easier for you. So we have developed a tool to help you easily generate the correct customs forms, which are ready-to-print and can be included with your international shipments. The tool will automatically complete all the required fields and determine whether you need to complete a CN22, CN23 or a Commercial Invoice.

It’s free to use, try it out here!

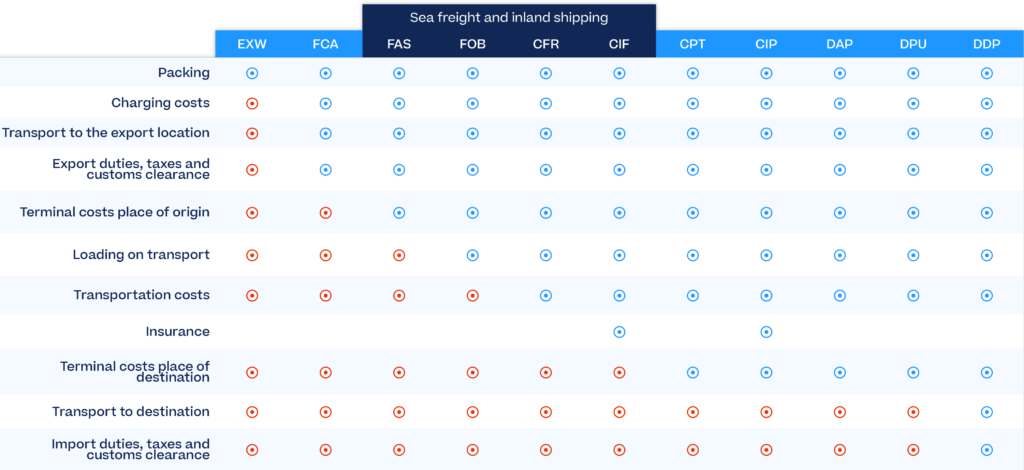

Brexit and Incoterms

If you’ve never shipped outside of the EU, then you might not be aware of Incoterms. But they are necessary for international shipments. So if the UK becomes a non-EU country with the same shipping rules, you will now need to use Incoterms to ship from the UK to the EU and from the EU to the UK.

Incoterms (International Commercial Terms) are a set of standardised international arrangements for transporting goods. They serve as a contract between seller and buyer and describe all tasks, risks and costs associated with the transactions of goods. They were developed to avoid misunderstandings.

It’s important to choose which Incoterm(s) you will use for which products and to which countries before you start to ship internationally. Incoterms are used to:

- State who is responsible for the cost of the shipment, insurance, import and customs costs of the shipment.

- Determine who is responsible for the transport and where to.

- Allocate when the risk and costs of delivery pass from seller to buyer.

Customs charges and other fees

With the eradication of freedom of movement of goods, there could be an introduction of customs charges and other fees when shipping between the EU and the UK.

If this arises, make sure to clearly communicate the situation to your customers. You will need to decide whether you will absorb these costs, or whether your customers will need to pay for them. This is why it is vital to determine your Incoterms, as they will stipulate who is responsible for these costs in your policies.

Whatever you choose to do, make sure to keep your customers informed. If your chosen Incoterms mean the customer will face custom or transport fees, make sure they are aware of this. If your customer is not aware, they could refuse the package. This means you could end up paying for the custom costs and the return of the package.

Returns

Current EU law protects EU citizens’ right to return a product within 14 days. However, it isn’t mandatory to offer returns to products shipped outside of the EU. So if you’re a business on either side, it will now be up to you to decide what you offer your customers.

However, our advice remains the same for any international shipment: It is a customer-friendly strategy to offer your customers the option to return if they want to.

Of course, offering returns will not be as easy as before. If you do decide to create a returns strategy, then you could choose from the following options to help your process:

- Outsource your returns to a local partner: Customers can return cheaply to their own country, then the partner can handle the return to your warehouse.

- Collaborate with an international logistics party: Make ready-made labels for the return shipments by making price agreements for both shipments and returns.

- International return solutions: Choose a party that offers a complete return solution on an international level.

Again, no matter what you choose, make sure to clearly communicate what you decide in your Returns Policy so they are aware of the terms they need to follow, and any costs they may incur.

Shipping without a hassle after Brexit

How To Prepare Your E-commerce store for Brexit?

Taking proactive steps to prepare for a post-Brexit world can help manage the impact. Preparing will help put you in front of your competitors and avoid any disadvantageous situations. As well as initiating a strong international shipping strategy, consider the following to continue ensuring your e-commerce store can keep operating effectively.

1: Check Suppliers

Arguably the most important thing to consider is to check your supply chain. Currently where do your products – or parts/materials to make your products – come from? If you predict Brexit could impact your supply chain then begin researching alternative or extra suppliers. This way you avoid any complications like tariffs or custom changes post-Brexit.

2: Stay Informed and Update Policies

Keep informed with the latest news to better assess the impact Brexit will have. Although there’s still some uncertainty, keeping track can help you judge the current forecast and help you prepare.

You will need to update shipping and tariff policies to reflect specific Brexit details. Of course, it is not currently possible to tailor new policies as Brexit is not finalised. But beginning to contemplate draft policies will help get updates ready once things become concrete.

Train staff with these changes in advance to avoid bottlenecks in operations once things change. Pre-warn customers that things are going to change so people aren’t caught off-guard.

3: Pricing

As mentioned, many of the new changes – shipping, supply chain, VAT – could result in needing to change prices. Whether deducting VAT or increasing the price due supplies costing more, make sure to prepare this in advance to reduce risks of loss.

Moving Forward

As soon as the Brexit transition period is over, we will have more concrete knowledge of how trade will continue between the two entities. We will make sure to update this article accordingly so you’ll have all of the right information available.

If you have any further knowledge or advice, then please leave a comment to share with the rest of the community.