Commercial Invoices are a crucial part to international shipping, and there is no escape. There is often confusion about which documents you need to include to get your package to its final destination as smoothly as possible. In this article we explain what a commercial invoice is, why you need this document and how to fill it out.

In this article, we will answer the following questions:

- What is a commercial invoice and what is it used for?

- Differences between a commercial invoice and other customs documentation

- How to fill out a commercial invoice

- Commercial invoice glossary – What should a commercial invoice include?

- Commercial invoice form generator

- How to add the commercial invoice to your shipment

- Paperless Trade for shipments via DHL Express or UPS

What is a commercial invoice and what is it used for? – A commercial invoice definition

Let’s dive right in and explore the fascinating world of Commercial Invoices! It’s crucial to understand this concept from the very beginning because it’s the key to smooth, hassle-free international shipping.

Commercial Invoice meaning

A Commercial Invoice is a special export document that helps your package get through customs. It is not just a routine piece of paperwork; it serves as a crucial documentation tool in international trade transactions. Essentially, it acts as a formal request for payment from the buyer to the seller for goods or services provided. It outlines key details of the transaction, including a description of the goods, their value, quantity, and terms of sale. Moreover, it serves as a legal document, providing evidence of the transaction and facilitating customs clearance processes.

When is a Commercial Invoice required?

A commercial invoice is required in international trade transactions when goods are sold across international borders. Packages within the EU do not require this special invoice. You can find a list of EU countries on the website of the Dutch Tax and Customs Administration, for example. If in doubt, you can also consult the list of exceptions because some countries or territories are part of the EU but are not part of the EU customs territory.

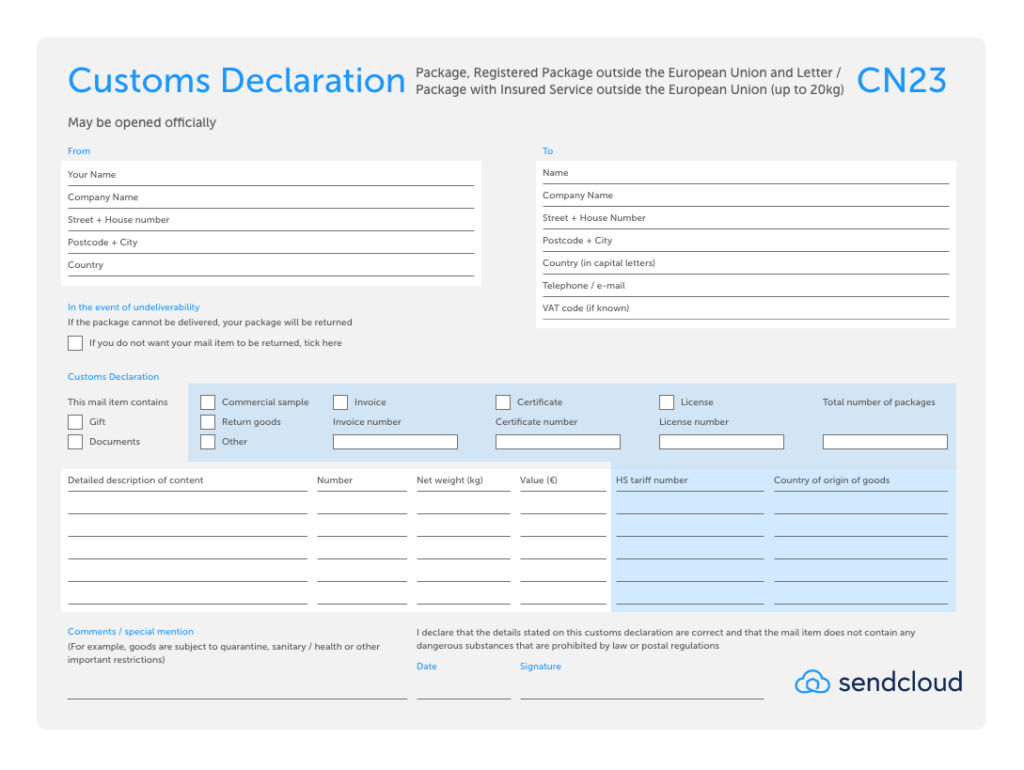

In addition to the commercial invoice, some international shipments outside the EU also require a customs declaration (CN22 or CN23), a CP71 dispatch note, and possibly a Certificate of Origin (CO). This article will mainly discuss commercial invoices for international shipping.

Risks of no Commercial Invoice

Not having a commercial invoice for international shipments can cause problems. Without this document, customs clearance may be delayed or even denied, leading to costly storage fees, returned shipments, or legal penalties. Also, not having a commercial invoice makes it harder to resolve disputes over payment, product quality, and compliance with trade regulations. A commercial invoice helps to avoid risks and make international trade more efficient.

What is a Commercial Invoice used for?

A properly completed and correct commercial invoice for export helps customs authorities quickly decide which taxes and import duties apply to your package. And this prevents delays.

In addition, customs officials can see whether your package meets all the requirements and they can pass on information (e.g. the recipient’s tax liability) to the country of destination. If you fill in this invoice correctly, there is a greater chance that your package will arrive on time.

Differences between a Commercial Invoice and other Customs Documentation

When sending an international package to a country outside the EU, you often need several documents. Sometimes people are confused about the difference between the Commercial Invoice and other customs documentation required for international shipments. This is not surprising: while both the Commercial Invoice and customs declaration forms, such as CN22 and CN23, provide customs authorities with information about the goods entering and leaving a country, they serve different purposes and should not be mixed up. So what exactly is the difference? Let’s find out:

Commercial invoice vs. CN22/CN23

A CN22 or CN23 form is a mandatory customs form that must be added to shipments outside the EU. The form is mainly used for shipments that are transported by a postal company. The value or weight of the shipment determines whether you use form CN22 or CN23. The form contains information about the goods being transported and this information is used to determine whether tax must be paid. A CN23 form is always accompanied by a CP71 dispatch note.

A CN22 or CN23 document requires you to fill in a bit more information than the commercial invoice, but the idea behind it is the same. Both documents provide information about the contents of the package so that customs authorities can decide whether the parcel can enter the country, and who is responsible for which taxes and import duties.

As explained above, the commercial invoice is also an export document that you add to all commercial shipments outside the EU. It is a binding customs document that mainly contains information about the contents of the package and the agreements made (Incoterms), such as who pays the customs costs. Based on the commercial invoice, the customs authorities determine whether import duties have to be paid on the goods.

So when do you use a CN22 or CN23 form, and when do you use a commercial invoice?

- If you are sending a package to a country outside the EU and using a postal service like PostNL (in the Netherlands) or Royal Mail (in the UK), use the CN22 or CN23 customs form. The CN22 or CN23 document is used by the Universal Postal Union and is therefore mandatory for postal services. You must also add a commercial invoice to this kind of shipment.

- If you are using a carrier such as DHL or DPD instead of a postal service, you do not need to add a CN22 or CN23 form.

The main difference is that a commercial invoice is always required for all e-commerce shipments, and only parcels sent via postal services need the additional CN22 or CN23 document.

However, to avoid delays, we recommend that you always add both documents.

Commercial Invoice vs. Packing List

While a commercial invoice provides detailed information about the contents of a package, including the value, quantity, and terms of sale, a packing list serves a different purpose. The packing list primarily documents the physical contents of the shipment, detailing each item’s dimensions, weight, and packaging type. While both documents aid in customs clearance, the commercial invoice focuses on the financial aspects of the transaction, while the packing list provides logistical information.

Customs Invoice vs. Commercial Invoice

A customs invoice, similar to a commercial invoice, is a document required for international shipments to provide customs authorities with essential information about the goods being imported or exported. However, a customs invoice may include additional details specific to customs regulations, such as the country of origin, harmonized tariff codes, and any applicable trade agreements or preferences. While there may be overlap between the two documents, the customs invoice is tailored to meet the specific requirements of customs clearance procedures.

Commercial Invoice vs. Shipping Invoice

While both documents provide details about the goods being shipped, a Commercial Invoice focuses on the financial aspects of the transaction, such as the value of the goods, payment terms, and the parties involved in the sale. On the other hand, a shipping invoice primarily documents the shipping and handling charges associated with transporting the goods, including freight costs, insurance fees, and any additional surcharges. While complementary, each document serves a distinct purpose in the international trade process, with the Commercial Invoice emphasizing the commercial aspects and the shipping invoice detailing logistical and transportation-related expenses.

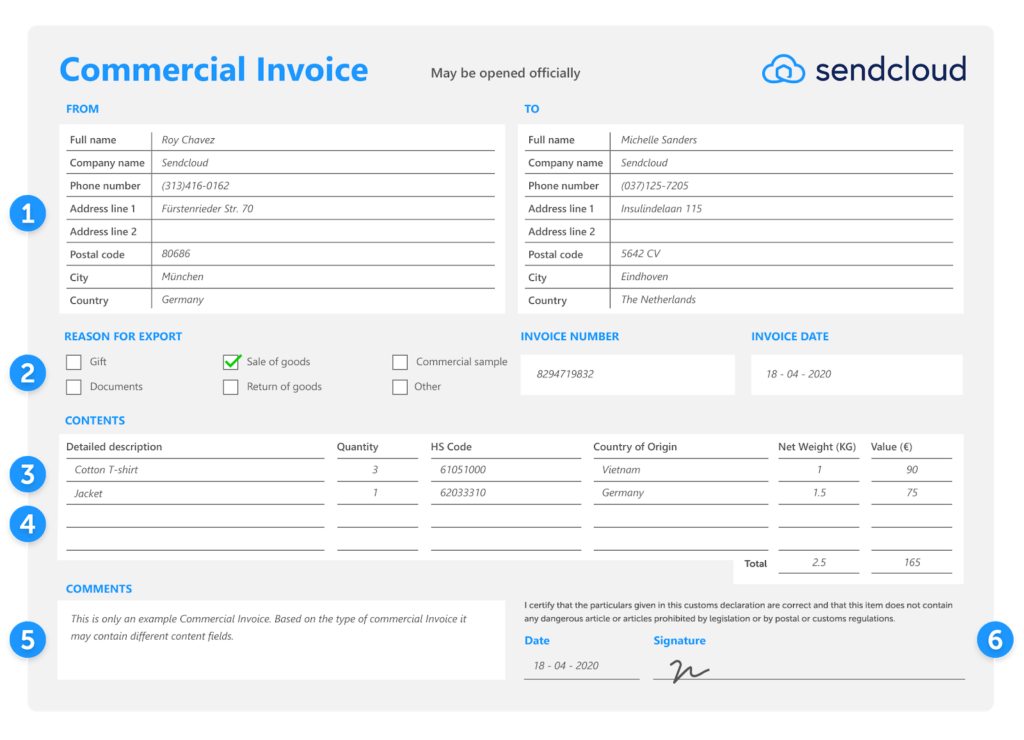

How to fill out a Commercial Invoice

What has to be on a commercial invoice? Although there is no standard format, the document must contain several fixed elements, such as details about the parties involved in the shipment and information about the goods. Below you will find the most difficult parts of the commercial invoice, and below that, you will find an explanatory glossary.

Please note: A commercial invoice must always be in English.

Or use our Commercial invoice form generator

Commercial Invoice example

What are you shipping: description of the article, number, weight, and value

It may seem obvious, but describing the contents of the package is an important part of the commercial invoice. This gives customs authorities a clear overview of what you are shipping. The description must explain exactly what you are sending, what the article is made of and, if applicable, what its purpose is. Do this for each item separately. Customs packages are often scanned, and you may be fined if the description does not match the contents of the package. Therefore, it is very important to do this accurately.

Also state the number of items, the total weight, and the total value in euros of the contents of your package. It is important that you determine the value accurately. Even a sample, gift or return shipment has a value.

HS code or commodity code

Every item in your package must have an HS code or commodity code. The Harmonized System (HS codes) classifies goods so that customs authorities know which taxes, excise duties, and controls apply. It is important that you enter the correct code as it determines the number of import duties or other taxes you must pay. Looking up the code can be difficult, but there are a number of ways to find your product’s code.

The manufacturer of your product often knows its HS code. If you don’t have this information, you can look up the code yourself. You can use Sendcloud’s quick and easy tool to search for the right HS code. Or, go to trade tariffs on the customs administration website and click on the ‘Nomenclature’ tab. There you will find all the commodity codes. Do you need more help? Then read the manual on looking up commodity codes. Finally, you can contact the tax and customs agency in your country for more information.

Country of origin

In the ‘country of origin’ field, you state where your goods were produced. In some cases, you will need a CO document as an additional document. Some countries outside the EU request this document for trade policy measures.

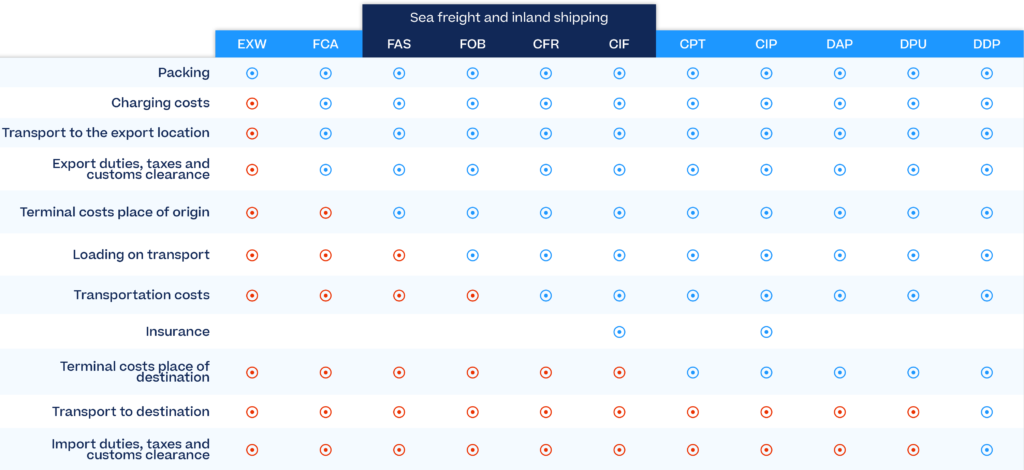

The Incoterms (or terms of sale)

The International Commercial Terms or ‘Incoterms’ are standardized international agreements on the transport of goods. The Incoterms clarify:

- Who is responsible for the shipping, insurance, import and customs costs of the shipment;

- Who takes care of the transport and to where;

- Who is responsible for the goods at each phase of the shipment, including the point at which the risk and costs of delivery transfer from the seller to the buyer.

Please note that the carrier you have chosen also supports these Incoterms.

The Incoterms are updated every ten years and so have just been updated for 2020. The 2010 Incoterms remain in force, but more and more companies will be switching to the 2020 Incoterms. Read our update about the 2020 Incoterms here. The most common Incoterms are EXW (Ex Works), FOB (Free on Board), CFR (Cost & Freight), DAP (Delivered At Place) and DDP (Delivered Duty Paid). If you don’t know which Incoterm is best for you, we recommend you choose DAP. This means that you as the seller pay the shipping costs, arrange the insurance and prepare the export documents. The recipient pays any import and customs duties.

Pssst – we’ve got great news for you! To make it easier for you to fill out the Commercial Invoice, we have created a template. Scroll further down to have a look! 👇

Commercial Invoice Glossary – What should a Commercial Invoice include?

We already mentioned that commercial invoices are always written in English. If you want to create your commercial invoice yourself or are using a template and don’t know what to fill in, you will find a description of the most common terms here:

- From: This is you, the person sending the package.

- To: The name and address of the person or company you are sending the package to.

- Intermediate Consignee: If you are sending the package to an intermediary, fill in the details of that person or company here.

- Date: The date you sent the package.

- Invoice Number: Your own invoice number.

- Customer PO No: Reference or order number of your sale.

- Currency Used: The currency you used when filling in the document.

- Country of Origin: The country where your product comes from. In some cases, you must add a CO document.

- Reason for export: Tick everything that is applicable.

- B/L/AWB No: This refers to the transport document setting out the arrangements with the carrier. The carrier is often responsible for preparing this document.

- Final Destination: The final destination of your package.

- Export Route/Carrier: The shipping company you are working with or the route your package will take.

- Terms of Sale: Better known as the Incoterms.

- Terms of Payment: The payment terms between you and the seller (e.g. payment within 30 days of receipt, direct deposit).

- Terms of Freight: Freight conditions (e.g. prepaid, collect). You can also enter these terms and conditions in the Terms of Sale or the Incoterms.

- No. of Packages: The number of packages you are sending.

- Comments: Space for shipping or delivery instructions or other notes.

- Contents: A description of the articles you are sending.

- HS Code: The HS code or commodity code.

- Value: Price per product.

- Net Quantity: Total number of products.

- Weight KG: Total weight of the package.

- Freight: If applicable, report the shipping costs here.

- Insurance: If applicable, report the insurance costs here.

- Date and signature: Your name, signature, and date. It may seem obvious, but your package will probably not be sent without your signature. So make sure to sign and date all your packages.

Create your Commercial Invoice using our Template

Buying internationally is getting easier, but international shipping remains a bit more difficult and filling in a commercial invoice is quite a bit of work. But we have made it a little easier with a handy template that helps you fill out this export document. This way you can be sure that your invoice meets all the current requirements and that the details have been completed correctly. Fill in all the details of your commercial invoice and then easily download your ready-made commercial invoice in PDF format.

How to add the Commercial Invoice to your Shipment

Normally you need to add three copies of the commercial invoice: one for the country you are exporting from, one for the country you are shipping to and one for the recipient. Put two of them in a packing list envelope on the outside of the package and put the last commercial invoice inside the package for the recipient.

Also, make sure that your package meets these other requirements:

- The box in which you send the package must be sturdy enough to withstand a fall of 1.5 meters.

- The package must be filled with padding material. Due to censorship rules, you may not use newspapers for this purpose.

- The corners of the box must be reinforced with tape.

It is important that you always keep a copy of the commercial invoice and any CN22 or CN23 documents. If mistakes are made in the handling of the shipment, you can sometimes face high customs fees. Be prepared for anything and keep a copy.

Paperless Trade for shipments via DHL Express or UPS

When you ship via DHL Express or UPS, you can use ‘Paperless Trade’. This means that customs forms are sent to the carrier electronically. As soon as you process your international order, the customs forms are immediately forwarded. This not only saves you time, printing and costs, but it also reduces the risk of documents being lost. Sendcloud automatically uses Paperless Trade when you ship outside the EU using DHL Express or UPS.

Commercial Invoice FAQ

What is a commercial invoice for customs?

A commercial invoice for customs clearance is a document that provides essential information about the exported goods, including their description, value, quantity, and terms of sale. It is used by customs authorities to assess applicable taxes, duties, and import regulations.

How many copies of a commercial invoice are required?

Typically, at least three copies of a commercial invoice are required for international shipments: one for the exporter, one for the importer, and one for customs authorities.

Who provides the commercial invoice?

The exporter or seller provides the commercial invoice to accompany the shipment.

Is a commercial invoice the same as a sales invoice?

While similar in some aspects, a commercial invoice is specifically used for international trade transactions, providing detailed information about the exported goods for customs clearance. A sales invoice, on the other hand, is primarily used for domestic sales transactions to document the sale of goods or services.

Does a commercial invoice need to be signed?

Yes, a commercial invoice typically needs to be signed by the exporter or their authorized representative to certify the accuracy of the information provided.

Do you need a commercial invoice to ship documents?

In most cases, a commercial invoice is not required for shipments of documents. However, it is advisable to check the specific requirements of the destination country and carrier.

Is a HS code required on a commercial invoice?

Yes, including a Harmonized System (HS) code on a Commercial Invoice is often required for international shipments to classify the goods and determine applicable customs duties and taxes.

Do I need a commercial invoice for returned goods?

Yes, you also may need a commercial invoice for returns, depending on the specific circumstances and the customs regulations of the countries involved. In many cases, a commercial invoice is required to document the value and nature of the returned items for customs clearance purposes. It’s advisable to check with your shipping carrier and the customs authorities of the destination country to determine the specific documentation requirements for returning goods.

Optimize Your International Shipments with Sendcloud

Congratulations on mastering the intricacies of Commercial Invoices! Now, let’s supercharge your shipping process with Sendcloud. Our platform offers a seamless solution for creating and managing shipping documents, including Commercial Invoices, ensuring compliance and efficiency every step of the way.

With Sendcloud, you can easily generate compliant commercial invoices using our intuitive Commercial Invoice template. Simply input the required information, and voila! Your commercial invoice is ready to accompany your shipments, facilitating smooth customs clearance and hassle-free international trade.

But that’s not all! Sendcloud empowers you with a range of tools and features to streamline your shipping operations. From automated order processing to customizable shipping options, our platform offers unmatched flexibility and convenience. Plus, with real-time tracking and notifications, you can keep both yourself and your customers informed every step of the delivery journey.

Ready to take your international shipping to the next level? Learn more about international shipping with Sendcloud today and experience the difference for yourself. Let’s revolutionize your shipping experience together!