Sendcloud Insurance

Affordable Shipping Insurance

Every day, packages get damaged, lost, or stolen. For as little as €0.38 the Sendcloud Insurance can have your back.

With every shipment, you risk losing time, money, or customers.

When a parcel is lost, you don’t know if it will be found and how long it will take.

So what do you do… Ship a new parcel? Wait? Risk upsetting a customer?

High value items

When damaged they result in a significant loss. You have to ship a new item and cover it out of your own pocket.

Fragile products

Break more easily during transport and when they do, they’re a big inconvenience to both you and your customers.

International shipping

When you ship internationally multiple parties are handling your parcel. This further increases the risk of damage, loss or theft.

That’s why Sendcloud provides you with affordable, yet reliable insurance.

Competitive Rates

Starting from as low as €0.38. Get a detailed overview of all rates here.

Worldwide Coverage

Available in 176 countries. Covering lost, damaged, and stolen parcels.

Full Refund

Get a full refund even when carriers don’t take responsibility for the damage or loss. Conditions apply.

How does it work?

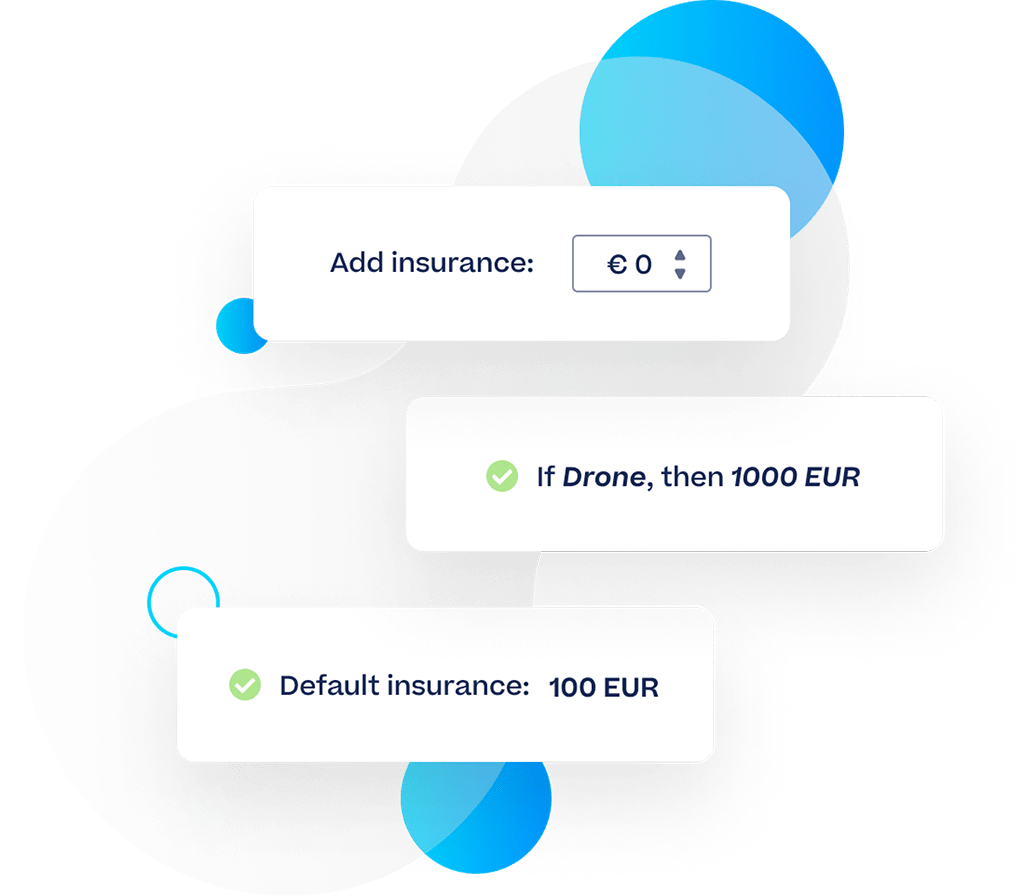

Add the insurance

You can do it in 3 simple ways:

Manually for a specific order.

Automatically with Shipping Rules.

Or by default for all orders.

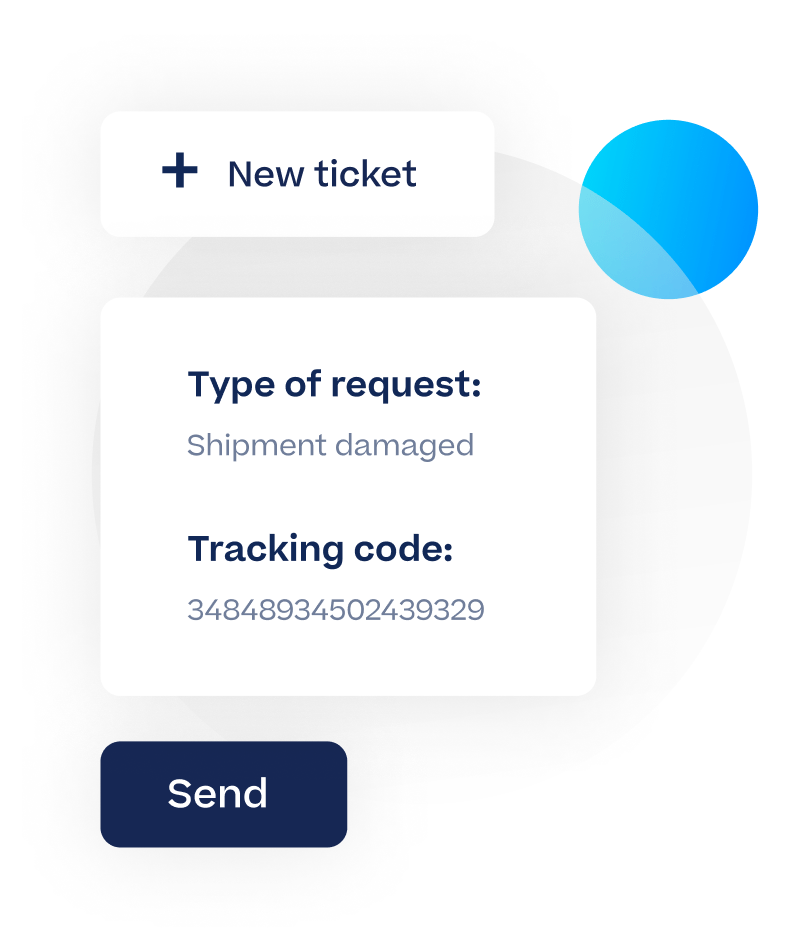

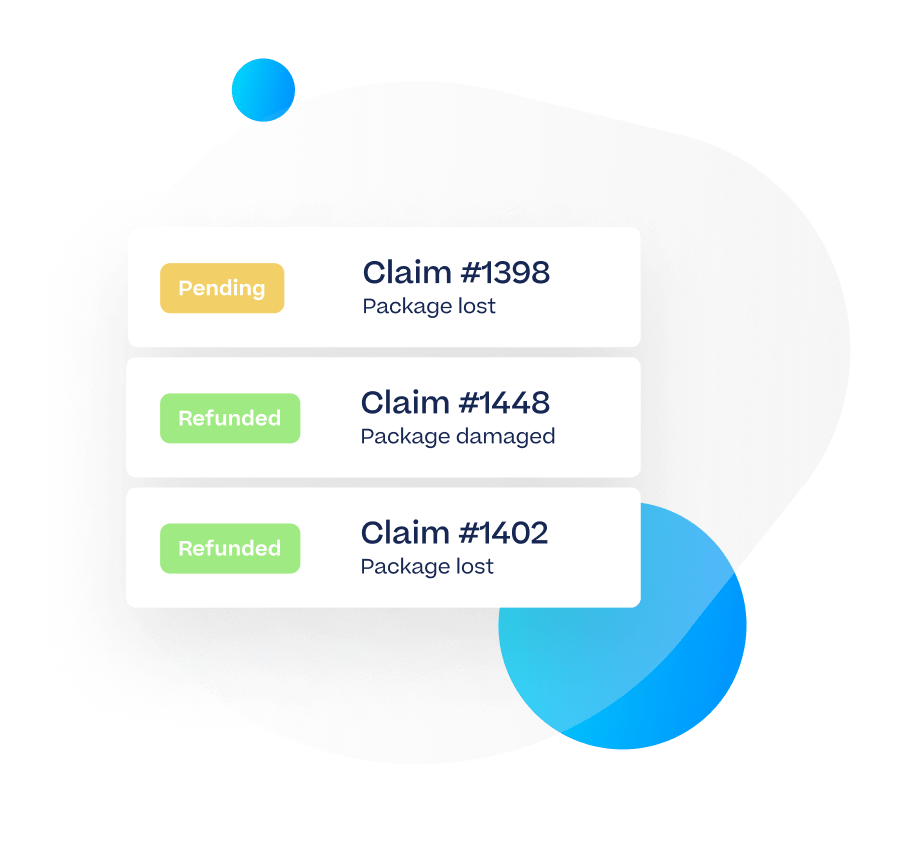

File a claim

You can file a claim in a few clicks right from inside Sendcloud.

Receive your refund

As soon as your claim is approved, you will receive a full refund of the insured value & shipping costs.

Insurance rates

Insured amount

Domestic

International

€0,01 – €100

€0,38

€1,00

€100,01 – €200

€0,85

€2,00

€200,01 – €300

€0,95

€3,00

€300,01 – €400

€1,10

€4,00

€400,01 – €500

€1,20

€5,00

Additional €100

€0,45

€0,95

Never worry about parcel loss or damage again

Getting insured is easy and can be done on-demand with every parcel, automatic with shipping rules, or by default for all parcels.

FAQ

What type of products are excluded from the insurance?

The following items products are excluded from the insurance (unless endorsed in writing):

- Flowers and plants

- Fine art

- Cotton (in its processed / unprocessed form)

- Fresh foods *

- Live animals

- Loose precious stones and metals

- Currency

- Cigarettes

- Eggs

- Specie

- Securities and other negotiable papers

- Staff good

- Bulk products

- Laptop computers

- Computer chips and similar memory devices

- Televisions

- Mobile Phones

More information you can find here.

Are there any countries excluded from the insurance?

Countries that are excluded from insurance:

Afghanistan, Angola, Bolivia, Burma, Iran, Iraq, Congo, Ivory Coast, Lebanon, Liberia, Libya, Nigeria, North Korea, Paraguay, Somalia, Syria, Zimbabwe, Russia, Ukraine.

More information you can find here.

How do I make a claim?

All information about Sendcloud Insurance you can find in this article.

What should I look out for when sending insured packages?

All information about packaging conditions you can find in this article.